INVESTMENT RETURN GOALS

15%

INTERNAL RATE OF

RETURN (IRR)

5%

Preferred Return

70%

LP Ownership after 100%

principal return

30%

GP Ownership after 100%

principal return

“ Our goal is to return your initial investment as soon as possible ”

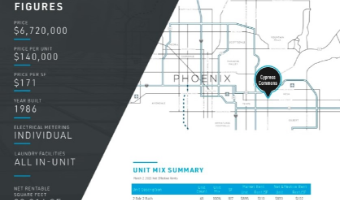

INVESTMENT OVERVIEW

1802 Capital took ownership of Cypress Commons on 8/28/20 for $6.72M. It has since been re-named and re-branded to River Rock Apartments.

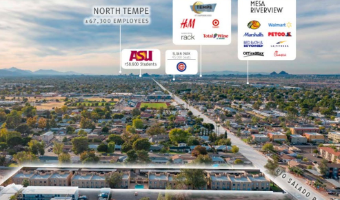

River Rock Apartments is a 48-unit apartment community located off of Rio Salado Parkway in Northeast Mesa. The Property is centrally located between Downtown Mesa and the Mesa Riverview, a major shopping destination with such tenants as Walmart, Home Depot, LA Fitness, Bass Pro Shop, Cinemark Mesa 16, Marshalls, Bed, Bath & Beyond, Petco, Chick-fil-a and Cracker Barrell Old Country Store and Restaurant. Just beyond the Mesa Riverview shopping center (one mile west of Cypress Commons) is Riverview Park, an expansive recreational area which includes Sloan Park – the 15,000 seat major league baseball stadium and spring training home of the Chicago Cubs.

Developed in 1986, Cypress Commons is comprised of 48 two-bedroom, two-bath floor-plans averaging 817-square-feet. All units are condo-mapped and include in-suite laundry, private patios/ balconies and fireplaces. 1802 Capital will have the opportunity to execute a programmatic interior renovation program across all of the units with an expected premium of $300+ per month.

The business plan involves increasing the net operating income over a 5 year period through equity creation, or ”forced equity.” The primary strategy is to normalize rents (bring to market value) and upgrade interior classic units to attain rent premiums, all while maintaining high occupancy rates to ensure continuous cash flow. The capital expense budget includes several exterior improvements to enhance curb appeal and improve tenant satisfaction.

6 Month UPDATE

In the first half year of ownership, the apartments have been rebranded to River Rock Apartments. New signage and paint has provided a modern and aesthetically attractive curb appeal to the property. First floor patio space was doubled to provide a premium feature for residents of the first floor units. Brand new pool furniture has been added. Bright lights have been installed in the parking lot and at each doorway entry to provide increased security. Interior units received fresh paint, new vinyl plank flooring, new stainless steel kitchen appliances, new in-suite washers and dryers, new cabinet fixtures, newly resurfaced countertops, new ceiling fans, and refurbished bathrooms. Nine out of the 48 units have already been leased at our premium rates which represents a $3,600+ increase in annual rent (35% increase over previous rent).

While tremendous renovations have already been completed, there are many more projects in the works to turn River Rock Apartments into a resident-friendly and modern living space. River Rock will be repairing and slurry sealing the parking lot asphalt and re-striping the parking spaces to create a beautiful new parking surface. The inoperable sliding gate into the property will be repaired and will be keypad operated to increase security for the tenants. Five large dead trees will be removed and new landscaping will further the curb appeal. A large ramada with built in BBQ area will be constructed at the end of the property to give residents a place to hold family picnics and entertain. We anticipate further rent increases in the back half of our first year of ownership.

12 Month UPDATE

We aim for aggressive returns quickly to provide our investors the option to reinvest their capital expeditiously to maximize returns. The work done on River Rock to increase its value has been very successful and the property is UNDER CONTRACT to sell at the end of September 2021. The sale price is $11.04M, which represents a $4.32M increase in value in 13 months!

Post Renovation MONTHLY Rent Comparison

$840

BEFORE

$1,210

AFTER

A $370 increase in monthly rent equals an increased annual NOI of $4,440. At a 4.5% cap rate this equates to $98,667 of forced appreciation (increased equity) per interior renovation.